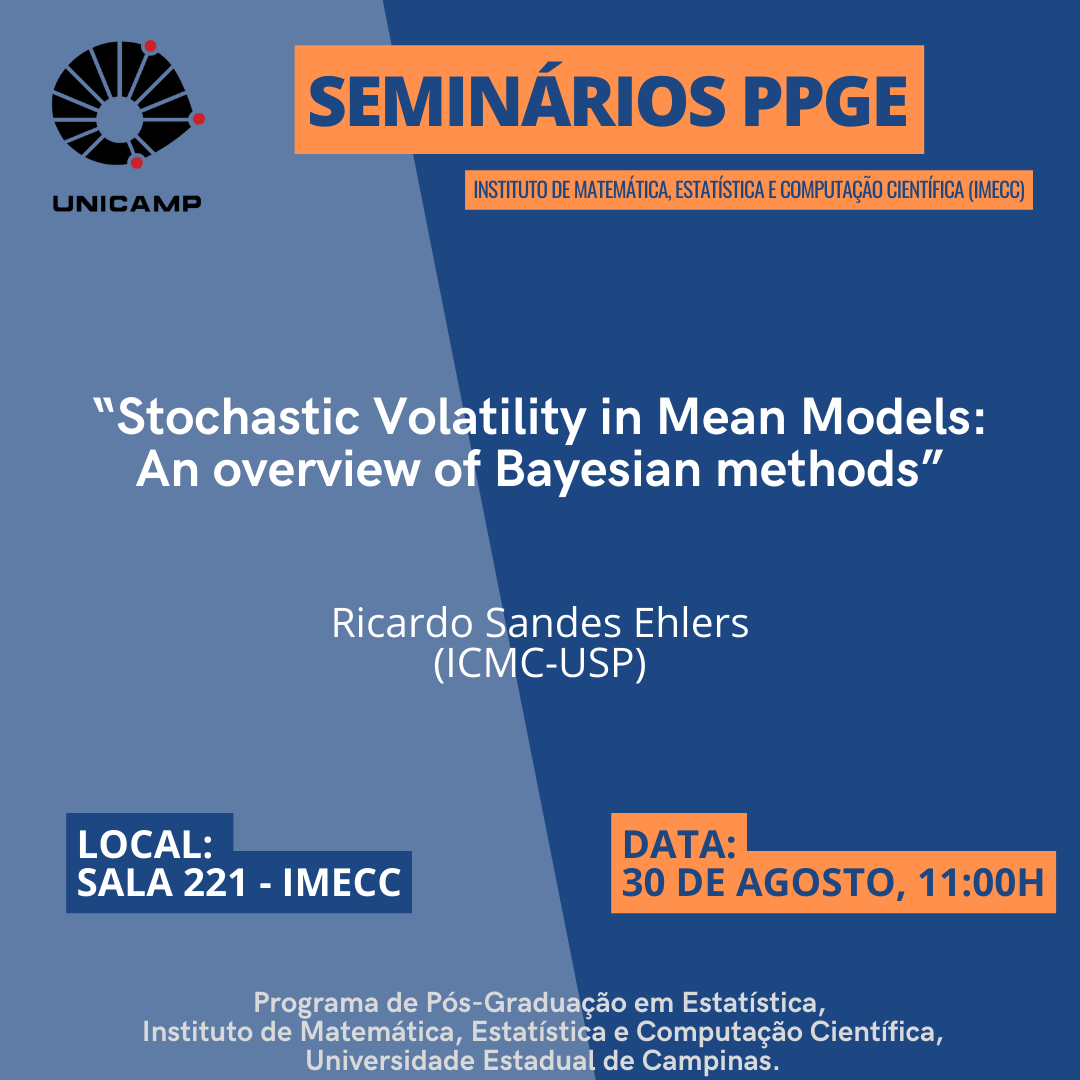

Resumo: When it comes to estimating volatility in financial returns the literature on stochastic volatility models is enormous. These models are flexible enough to capture the nonlinear behaviour usually observed in financial time series of returns.However, SV models rely on pre-modelling the original series to avoid the simultaneous estimation of the mean and variance. To tackle this problem an SV in mean (SVM) model was proposed in which the unobserved volatility is incorporated as an explanatory variable in the mean equation of the returns. In this work we investigate recent advances in the Bayesian analysis of these models.

Short-Bio: Senior Lecturer at Department of Applied Mathematics and Statistics, Institute of Mathematical and Computer Sciences, University of São Paulo. Served as Chair of the Graduate program in Statistics UFSCAR/USP and President of the Brazilian Chapter of ISBA. Member elected of the Latin American Regional Section of the IASC-ISI. Associate Editor for the American Journal of Mathematical and Management Sciences. Primary research interests: Computational Statistics, Bayesian Statistics, Markov chain Monte Carlo methods.